An Honest Look at AKN Token Centralization and Market Realities

As of mid-2025, the condition of Akoin (AKN) on the Stellar decentralized exchange (DEX) paints a sobering picture. Originally launched with the ambitious goal of empowering African entrepreneurs, Akoin now appears to be little more than a stranded asset on Stellar’s ledger, marked by extreme centralization, minimal liquidity, and negligible trading activity.

Price and Supply Overview

- Quoted Price: $0.003*

- Total Supply: 449,998,783 AKN

- Trustlines: 571 total / 364 funded

- Implied Market Cap: ~$1.35 million (*based on quoted price)

This market cap should be taken with skepticism. There is no meaningful market on which to sell even a fraction of the circulating supply. Bitmart and Bittrex both hold zero AKN tokens, and liquidity on the Stellar DEX is severely lacking.

Token Centralization

The top four wallets, presumed to be team-controlled, each hold roughly 100,000,000 AKN, accounting for 88.88% of the total token supply. This leaves only 11.12% of AKN in circulation, about 49.9 million tokens.

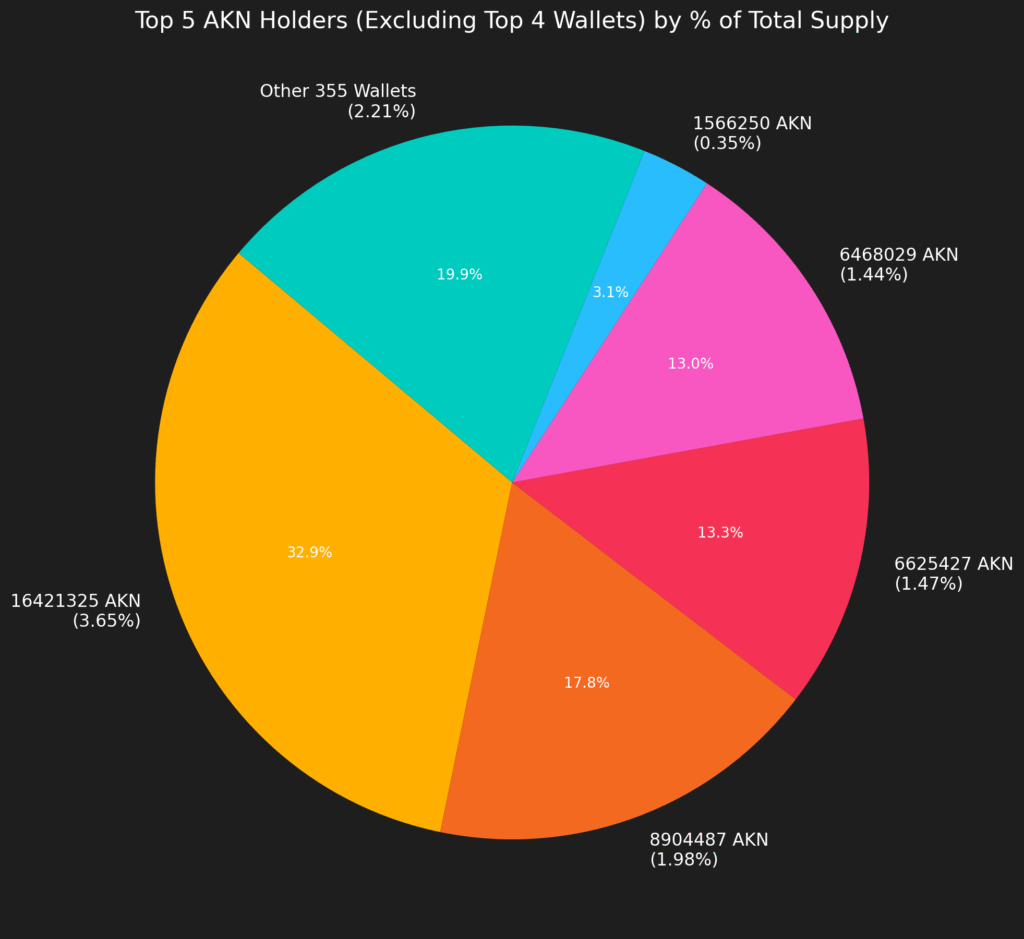

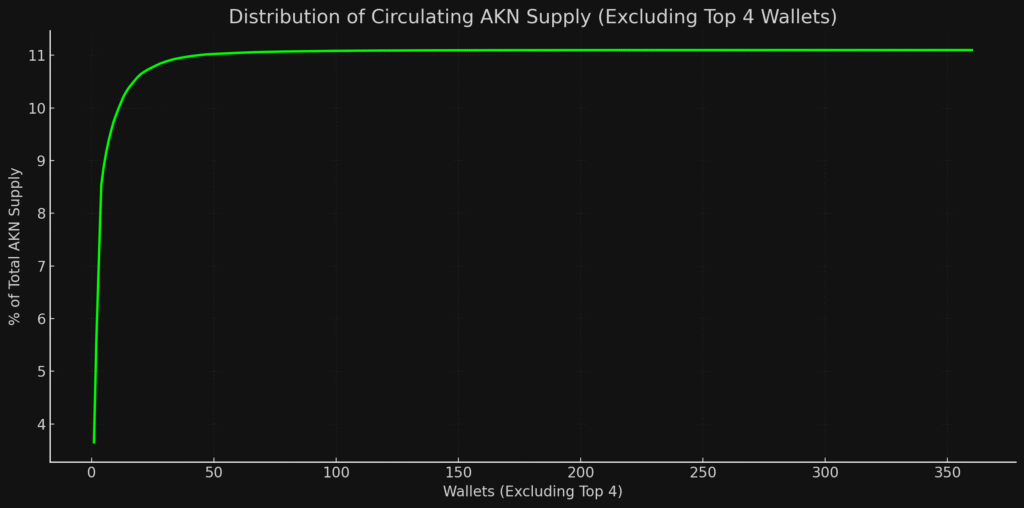

Even within this 11.12% of circulating supply, centralization is severe:

- The fifth-largest wallet holds over 16.4 million AKN, skewing the average wallet holdings significantly.

- With this wallet included, the average holding among non-top-4 wallets is ~138,722 AKN.

- Without it, the average drops to ~93,366 AKN.

- Removing just the 6th, 7th, and 8th largest wallets (which collectively hold over 3 million AKN) causes the median holding to collapse to just 200 AKN.

This means that while a small number of wallets appear “active” or “invested,” the overwhelming majority of wallet holders own very modest amounts, often too little to meaningfully participate in any price movement or governance.

To put this in perspective, four non-Akoin team wallets represent about 76.78% of the circulating supply of AKN.

Exchanges and Trading Volume

Exchange Presence

- Bitmart: 0 AKN

- Bittrex: 0 AKN

- Altilly: ~58,473 AKN (across three wallets)

The only centralized exchange still potentially trading AKN is Altilly, and even then, its holdings represent:

- 0.013% of total AKN supply

- 0.117% of the supply circulating outside the top four wallets

These amounts are not significant enough to influence liquidity or act as an escape hatch for holders.

Trading Volume

- XLM/AKN 24-Hour Volume: ~$33

- USDC/AKN 24-Hour Volume: ~$97

- XH5/AKN 24-Hour Volume: ~$7

Combined with the absence of centralized exchange liquidity, these numbers make it clear that AKN is in a stagnant and illiquid state.

What This Means

- Liquidity Is Functionally Dead

With virtually no volume and only a handful of meaningful holders, AKN cannot support organic price discovery or fair trading opportunities. - Perceived Average Holder Size Is Misleading

A few large wallets skew averages and mask the reality that most token holders possess only a few hundred AKN. - Community Fragmentation

With no clear leadership, communication, or roadmap, the community, if one still exists, is fractured and directionless. - Centralized Supply Kills Trust

Reviving community trust requires fair and distributed access to tokens. Akoin fails here spectacularly.

The Glimmer of Utility?

If Altilly maintains even a modest AKN market, arbitrage opportunities between that exchange and the Stellar DEX may exist. However, with such minimal volume and uncertain access, this is more a speculative idea than a viable strategy.

What remains of Akoin is a case study in how a high-profile crypto project can collapse silently after a flashy debut. Whether due to neglect, incompetence, or changing priorities, Akoin has become effectively non-functional from a market perspective.

The project’s extreme centralization, lack of trading volume, and absence of community engagement make any serious recovery look unlikely, at least without significant intervention or reinvention.

In a future post, I’ll explore whether Akoin could be rebranded, repurposed, or revived in any meaningful way, not because I believe Akon intends to return to the project, but because even failed tokens might offer unique lessons, or second lives.

Find out more about Akoin’s (AKN) Troubles

Disclaimer: None of this is financial advice. Always do your own research (DYOR) before making any investment decisions. Cryptocurrencies involve significant risk, and any opinions shared are for informational purposes only.